I couldn’t resist the chance to start a blog post with a quote from one of my favourite movies… Good Will Hunting (1997) starring Matt Damon, one of my favourite actors. Yet I digress…

The truth is, with the price of apples these days, you had better like them apples an awful lot! I recently purchased 3 Pink Lady apples at Safeway and paid $3.59! That is $1.20/apple! I am the first to admit that I am an apple snob. There were less expensive apples on offer – Macintosh and Spartan – but I do prefer Pink Lady and Royal Gala. We are a family of 4; for each of us to have an apple a day (to keep the doctor away!), would cost $4.80/day, $33.60/week, and $144/month. Who can afford that?!?

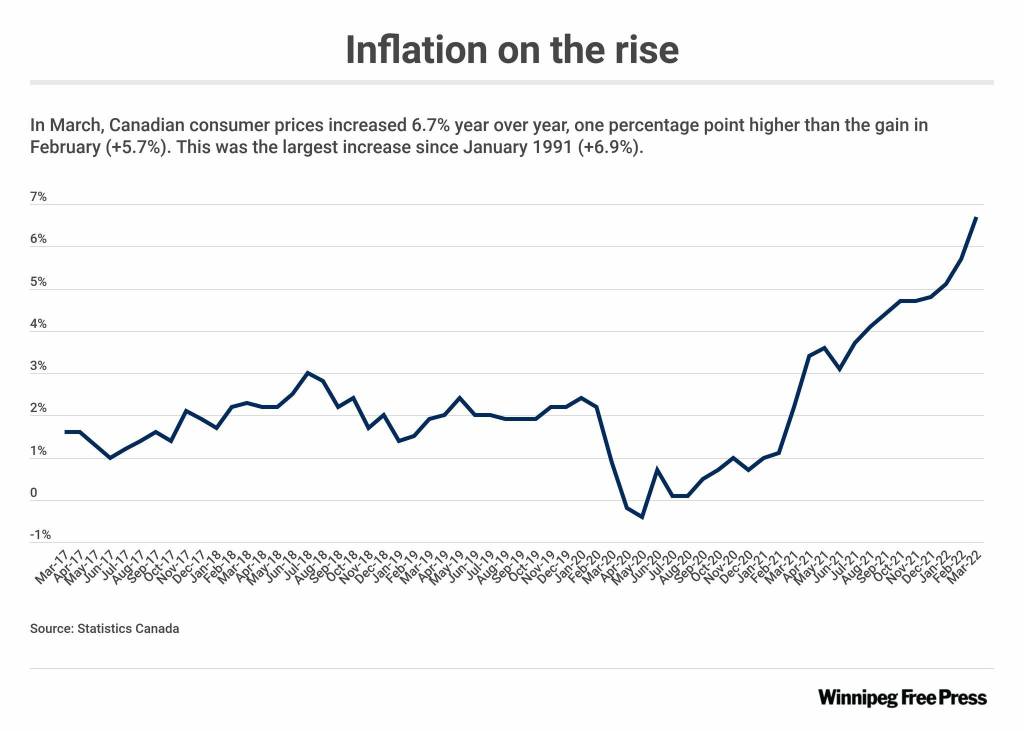

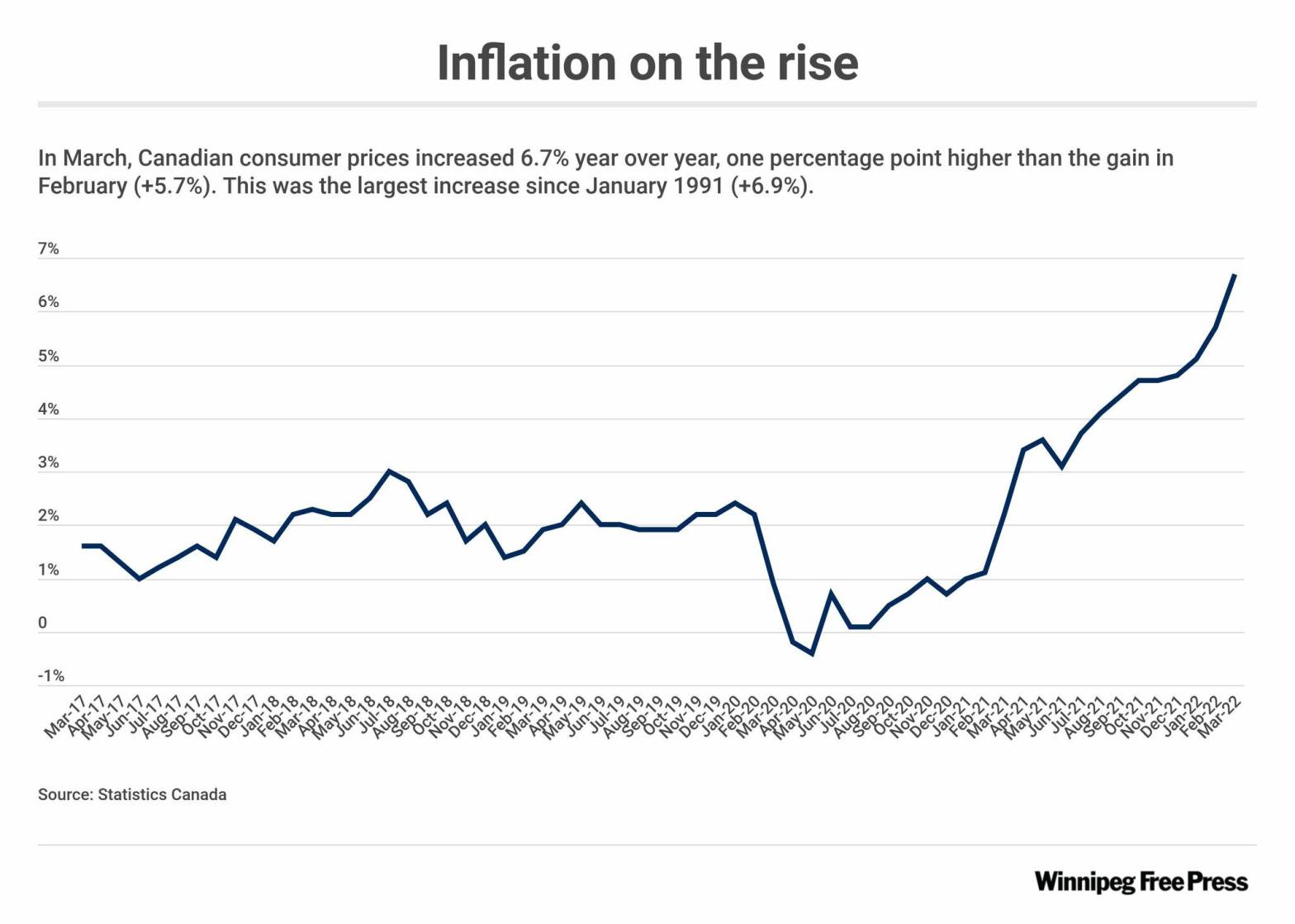

There has been much discussion of inflation in 2022. Canada’s inflation rate hit 6.7% in March 2022, compared to March 2021. Grocery items, a necessity, are one of the things that are driving this increase in inflation. Food prices rose 7.4% in February 2022, compared to February 2021. Common household grocery items increased at staggering rates – beef 16.8%, chicken 10.4%, pasta products 17.8%, breakfast cereal 12.3%, and dairy products and eggs 7%. These price increases disproportionately affect lower income households, as grocery purchases are necessities and demand for these items is relatively inelastic.

Canada’s current inflation rate is artificially high for several reasons. First, the comparative reference point, March 2021, was likely lower due to the COVID-19 pandemic. Second, increased demand, some again attributable to the pandemic, has contributed to higher prices. Do you remember the soaring cost of lumber in 2021? Third, many industries are experiencing supply chain disruptions. All else equal, a reduction in supply leads to an increase in prices. And finally, the war in Ukraine has caused oil prices to rise to over 13 year highs.

The Bank of Canada started increasing its benchmark interest rate on March 2, 2022. This was the first increase since 2018. At its last meeting on April 13, 2022, the Bank increased the overnight lending rate by a further 0.5%, which was the largest individual rate hike since 2000. Economists expect multiple rate increases in 2022, including another possible 0.5% increase at the Bank’s next announcement date of June 1, 2022.

Why is the Bank increasing the overnight lending rate? Stated very simply, increasing interest rates decreases inflation. A higher interest rate means that it will cost more to borrow money. Consequently, people may choose to borrow less, or to not borrow at all. Thus, fewer funds are available for consumer purchases, which reduces demand for goods/services. All else equal, a reduction in demand leads to a decrease in prices. Over time, this will result in a decrease in Canada’s annual inflation rate. But the decrease will take time. The Bank of Canada has said previously that they expect inflation to remain close to 5% over the first half of 2022, before easing to about 3% by the end of the year.

You might be wondering: How does this affect me? If you have borrowed, or need to borrow, funds, an increase in the overnight lending rate may increase your cost of borrowing. For me, personally, this will affect the interest rate on my mortgage, as I entered into a variable rate mortgage in 2018. If your mortgage rate is fixed, you will not be affected by the rate increase until it is time to renew for another term.

I work with medical students, many of whom fund their medical studies using a professional line of credit. These rate increases will increase the interest rate on a student LOC, or any other bank loan whose interest rate is determined as a function of the prime interest rate. Consequently, the total cost of borrowing will be higher, as interest rates rise.

I caution my medical students, and others, to use credit prudently. Consider needs vs. wants when making purchases with borrowed funds. Purchases that you make today at current interest rates will need to be repaid in the future at a higher rate of interest (perhaps long after you have enjoyed the item/experience that was purchased).

If you have surplus funds on hand and are looking to invest them in a short-term investment vehicle such as a GIC, you are in luck! Interest rates on invested funds have been at rock-bottom, but have recently started to creep up. As an example, the rate at a local Credit Union on a 1 year fixed rate GIC is currently 2.05%. This is already approximately 1% higher than it was prior to the Bank of Canada’s interest rate announcements. As the overnight lending rate increases, expect that the rates on GICs will increase as well. However, when compared to an annual inflation rate of 6.7%, you are losing purchasing power by investing in the 1 year GIC. On the other hand, you will benefit from the security of a guaranteed investment and avoid the current stock market volatility that we have been experiencing in 2022.

It will be interesting to see what 2022 has in store. Further commentary to follow as the year unfolds.

I love Good Will Hunting! The bar scene, the hamburger kiss, the hug with Sean are my faves.

But you need to try honey crisp apples. They’re the best.

LikeLike