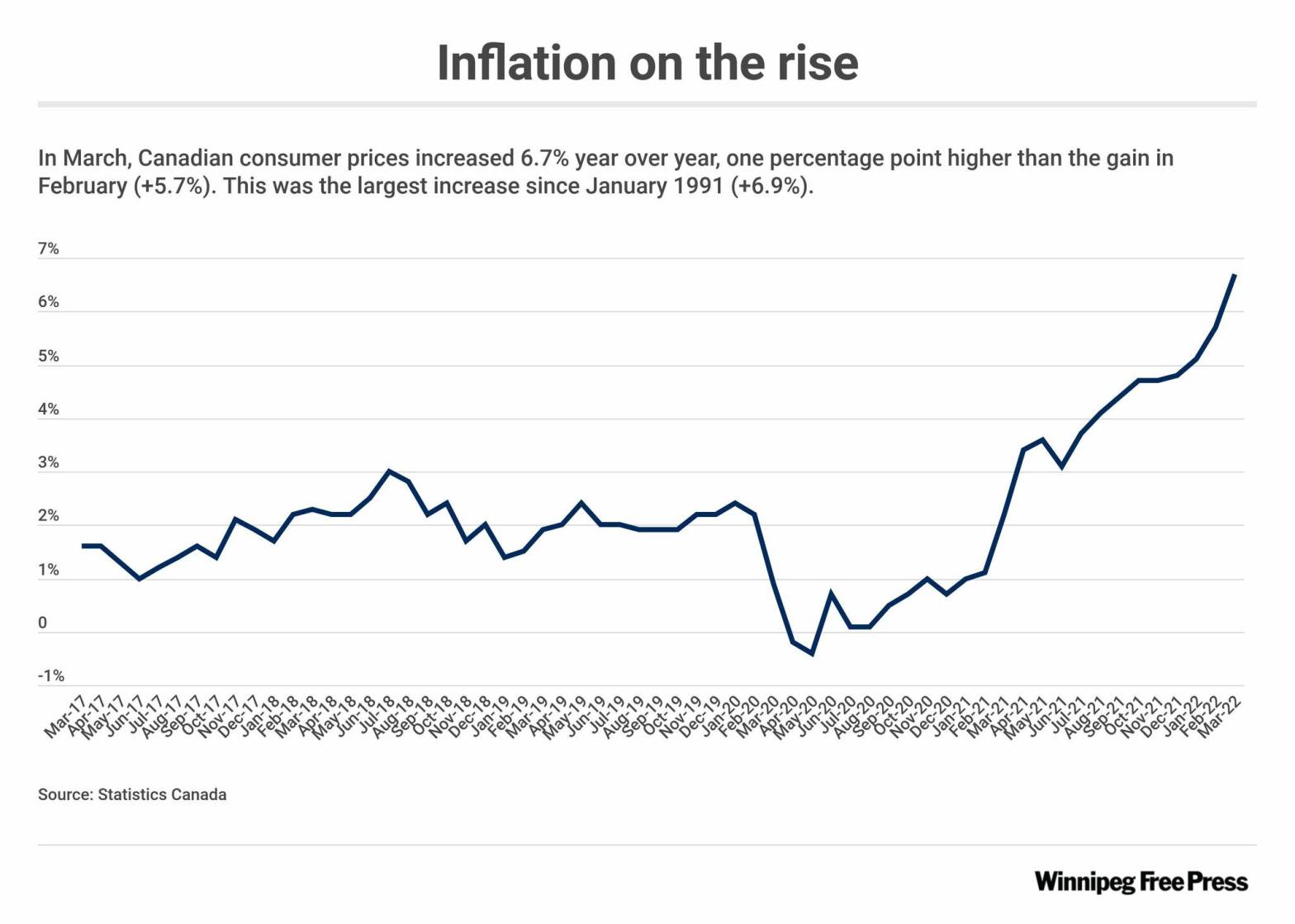

This blog post is a follow-up to my April 2022 post “How Do You Like Them Apples?” which discussed the rising inflation and interest rates that were experienced in Canada in early 2022. In an effort to reduce inflation, The Bank of Canada (the Bank) started increasing its benchmark interest rate on March 2, 2022.Continue reading “What Goes Up Must Come Down… Eventually”

Tag Archives: financialindependence

Lions and Tigers and Bears, Oh My!

Ok, there are no lions and tigers, but there are bears – a bear market, that is! The US Securities and Exchange Commission defines a bear market as a “time when stock prices are declining and market sentiment is pessimistic. Generally, a bear market occurs when a broad market index falls by 20% or moreContinue reading “Lions and Tigers and Bears, Oh My!”

How Do You Like Them Apples?

I couldn’t resist the chance to start a blog post with a quote from one of my favourite movies… Good Will Hunting (1997) starring Matt Damon, one of my favourite actors. Yet I digress… The truth is, with the price of apples these days, you had better like them apples an awful lot! I recentlyContinue reading “How Do You Like Them Apples?”

Year End Portfolio Review

Today’s post is the conclusion to last week’s post, How I am Helping my Children Form Their Money Mindset. Last week, I shared my sons’ experiences with fractional trading with Wealthsimple. In today’s post, I will review the investment performance of each boy’s stock portfolio and share some commentary from Big W and Little JContinue reading “Year End Portfolio Review”

How I am Helping my Children Form Their Money Mindset

Today’s post builds on my November 22, 2021 post, The Importance of Our Money Mindset. In that post, I wrote that “many of our core beliefs about money are formed in early childhood by observing how our parents, friends, and classmates talk (or don’t talk) about money.” The post talked about my childhood, and theContinue reading “How I am Helping my Children Form Their Money Mindset”

Budgeting to Reduce Financial Stress

Last week, I attended the Chartered Professional Accountants (CPA) Mastering Money Virtual Conference 2021. It was a thought-provoking program, covering both personal finance and issues affecting small and medium sized businesses. As is the case with these conferences, I have a long list of follow-up reading to do, with some commentary to follow in theContinue reading “Budgeting to Reduce Financial Stress”

Happy Financial Literacy Month!

November is Financial Literacy Month. During Financial Literacy Month, the Financial Consumer Agency of Canada (FCAC) works with private, public, and non-profit organizations to engage with Canadians in order to help strengthen the financial literacy of individuals and families. What is Financial Literacy? According to FCAC (2019), financial literacy refers to a combination of financialContinue reading “Happy Financial Literacy Month!”

FIRE and Freedom 43

In 1984, London Life Insurance Company introduced the idea of Freedom 55, an attempt by the insurer to inform Canadians of what it took to retire at a relatively young age. I grew up with this concept, and the tagline stuck with me – so much so that I named my retirement plan Freedom 43.Continue reading “FIRE and Freedom 43”